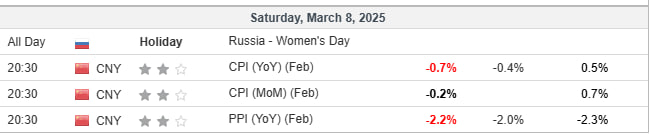

The verdict is out: China’s latest inflation data signals deflationary risks. The Consumer Price Index (CPI) fell by 0.7% year-over-year, exceeding the expected 0.4% decline. Similarly, the Producer Price Index (PPI) dropped by 2.2%, an improvement from the previous period but worse than the anticipated 2% decrease.

This does not bode well for the Chinese stock market rally, which had gained momentum following January’s exceptionally strong CPI data.

Should We Be Negative About China’s Economy?

Not entirely. A closer look at the monthly comparison reveals that CPI declined by 0.2%, which was in line with forecasts. This was not an unexpected figure, as seasonal factors had contributed to January’s strength.

Why Was January’s CPI Figure So Strong?

The surge in January’s CPI was largely driven by seasonal factors. China’s largest annual holiday, which took place in January this year (as opposed to February last year), led to increased consumer spending. Households stockpiled food for large family gatherings, fostering a “spend-and-spend” mentality that boosted economic sentiment and price levels, temporarily lifting CPI and PPI.

Will PPI Improve?

There are signs of stabilization in the Producer Price Index. However, we remain cautious about any overly optimistic outlook. A return to positive territory in the near term remains unlikely due to persistent industrial overproduction, which continues to weigh on prices. Nonetheless, any slight improvement is a welcome development.

What Can the Stock Market Expect?

There is no quick fix for deflation risks. We anticipate further monetary easing measures from the Chinese government, as we previously shared in our Telegram channel. This could include additional cuts to the bank reserve requirement ratio, injecting liquidity into the economy to maintain a looser monetary environment and support inflation.

Fiscal policies to boost consumption could help stabilize consumer confidence, encourage domestic spending, and improve sentiment and inflation readings. We view any market pullback as a buying opportunity, as China’s resilience stands out amid rising uncertainty in the U.S.

More Stories

Why Is China Holding Back on Large-Scale Fiscal Stimulus?

China on the horizon, for better or worse?

Nasdaq struggling with its 50-day Moving average