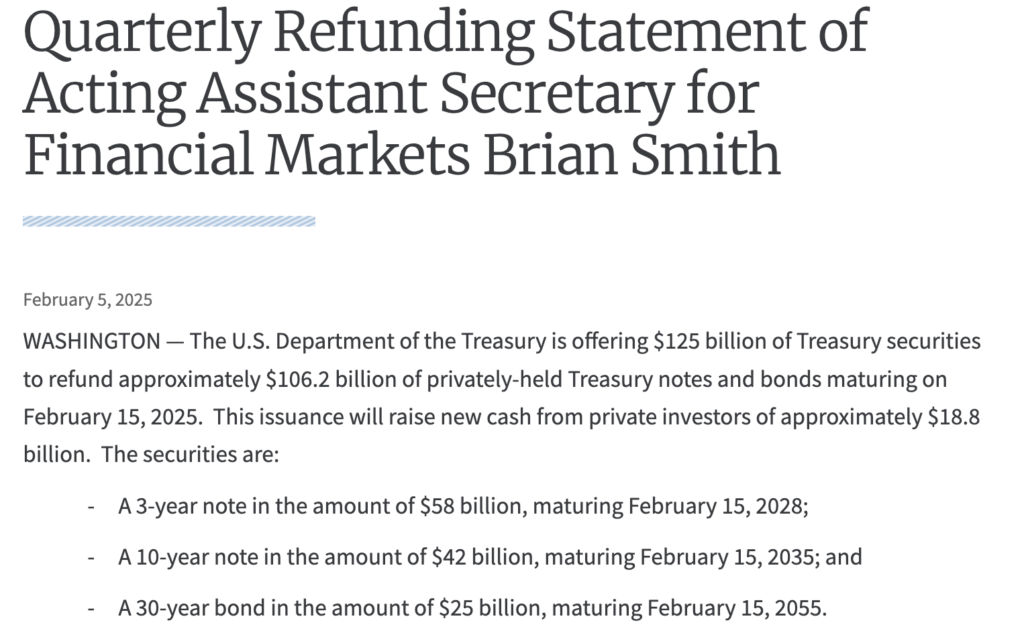

The stable and well-aligned expectations for U.S. Treasury quarterly funding have prevented shocks in the bond market, allowing the 10-year Treasury yield to dip below 4.5%. Additionally, easing crude oil prices has further alleviated inflation concerns.

While trade war threats persist, the peak of market anxiety appears to have passed, allowing investors to refocus on corporate earnings, which have largely met expectations. Among the 244 S&P 500 companies that have reported Q4 2024 earnings so far, 77% have exceeded analyst forecasts, compared to the long-term average of 67%.

Market participants will closely monitor Amazon’s earnings and Friday’s jobs report for further economic signals. However, heightened volatility is expected as President Trump’s policies continue to unfold.

More Stories

🚀It’s time for a re-assessment; then came Nvidia’s boost.🚀

A flip-flop markets into earnings season

Nvidia pushes the market to roar back.