🥁Equity markets roared back in the final hour of the trading session to pare losses and jumped higher in after-hours as Nvidia issued a robust set of earnings. Guidance is strong, and there’s much to anticipate for this AI revolution cycle, a simmering shift from AI platform enablers towards AI adopters.

🚀This shift will progressively broaden capital expenditure, which aligns with Nvidia’s CFO guidance that the current demand exceeds the supply level for upcoming chips. Indeed, there is much anticipation for the company’s critical next-generation AI chip, B100, which will be released in the next few quarters.

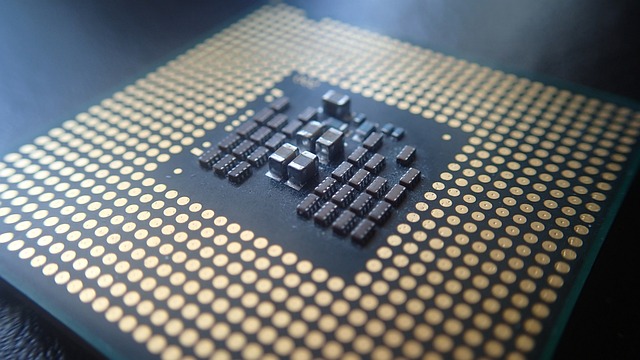

💰Much of Nvidia’s groundbreaking performance rests upon its revenue from the Data centre. As the CEO Jensen Huang said, it is a “pivot point”. The demand for its Hopper GPUs used in the training and inference of massive language AI models, and generative AI applications helped boost revenue. The earnings also revealed that large-scale cloud computing providers represent over half of its data centre revenue. This proves the resilience of its business units for the immediate quarters ahead.

🎢The collateral gains have spilt over to other AI stocks, such as AMD, Super Micro, and Palantir, which increased in sympathy with Nvidia’s share price. Broadcom is firmer after hours because it also makes chips used in AI data centres, especially for networking applications.

📪What’s on the menu today? 📖

1) At 9.30 pm, we will release the Initial Jobless Claims result. This will help us shed light on the performance of the labour market.

2) The S&P Global Manufacturing and ServicePMI will also be released at 10.45 pm as it will help us understand the health of the US economy.

3) Existing home sales will roll in at 11 pm.

4) We will welcome FOMC member Harker to speak at 4.15 am.

It will be a power-packed day as traders digest the latest healthy earnings of Nvidia’s result and the upcoming economic data to assess better the possibility of inflation trajectory and the soft landing narrative.

It is 22 Feb, Thursday, 9 am in Singapore and 9 pm in New York. The market has been incredibly resilient, and our hedge positions eat up our portfolio performance, but it is critical to help cushion during this volatile February.

Cheers.

More Stories

US Treasury announced latest quarterly refunding

🚀It’s time for a re-assessment; then came Nvidia’s boost.🚀

A flip-flop markets into earnings season