Stocks simply range on Tuesday as investors wait eagerly for the inflation figure before making their strategic move. It is no surprise again that the value component, Dow, saw a green day. Nasdaq saw selling pressure which should not be a surprise given that QQQ has risen tremendously during 1Q2023. Thus some lightening of position is understandable.

There’s no negative surprise from BOJ Governor Kazuo Ueda, who maintains that the current stimulus monetary policy remains relevant. Recall earlier that a perception change in BOJ policy had caused confusion and pressure on global equities.

Consumer Price Index (CPI) data in focus

There is also a key question on whether the Fed believes that the banking turmoil will have a restrictive monetary condition on the general economy, which, therefore, could suggest a lesser rate hike.

Still, banking worries seem to start fading, and the Fed might be more ready to confront inflation on a full scale. We wish to highlight that the S&P 500, which has been ranging from 3800 to 4200 level is now at the 4100 level, which has often sparked selling pressure. Hence, CPI will be pivotal.

Bitcoin- Hitting the Roof above $30,000

The world’s leading cryptocurrency has a world for all – I am a bull now! Yes, after crashing since last summer, price are swinging back up. The bull is back in the house.

Bitcoin leap 6% for the past 24 hours to exceed the $30,100 mark. For the past weeks, we have seen the price consolidation around $28,000 before moving a leg up. The rest is history, as analysts quickly call for a new “bull” cycle.

FOMO is creeping in and that could provide another stimulus for a jump. But we would caution that profit-taking at the current level seems possible too, but as with current momentum, the upswing is likely to continue.

It’s all about probability. Since there is a considerable bearish bet on shorts, it could also lead to possible liquidation from here. The headwind from higher interest rates is starting to fade as most expect the Fed to start its more accommodative stance this year as the rate hike cycle may pause soon.

What’s on the menu today?

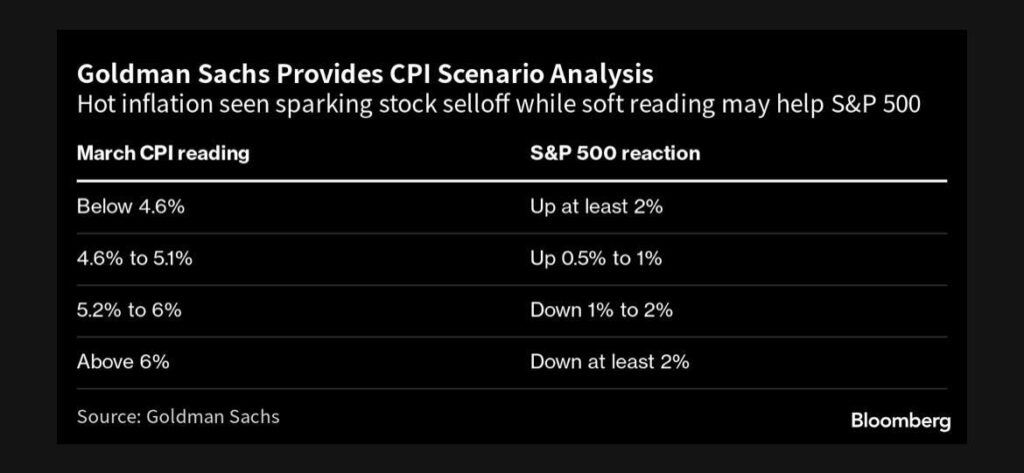

You know it. At 8.30 pm, we will have the CPI data released. There is some expectation. Here’s one table to show Goldman Sach’s expectation.

It is 12 April, Wednesday, at 9 am in Singapore and 9 pm in New York. It has been a ranging trading week and tonight might be the key push for major indices to find their direction. I look forward to further discussion on the latest data!

Follow us on our socials!

Instagram: @themoneynmeaning

Telegram: https://t.me/invest_with_pika_world

More Stories

Markets in risk-on mode with year end rally on track.

Consumer Discretionary Stocks Lead Losses, Hinting at Recessionary Concerns

All is well.