The PPI had risen 8% over the year, which is lower than the 8.4% expected. Companies faced with a minor cost increase bode well for the inflation narrative. It hints that the selling prices of products could start to cool down and support a projected weaker inflation story for the future.

The latest PPI data further validates the hint with the recent CPI data that inflation is possibly declining. This shows the comprehensive spread support of such a notion, and indexes could sustain their green despite geopolitical risk arising from the Ukraine war as missiles appeared to have hit NATO alliance country – Poland.

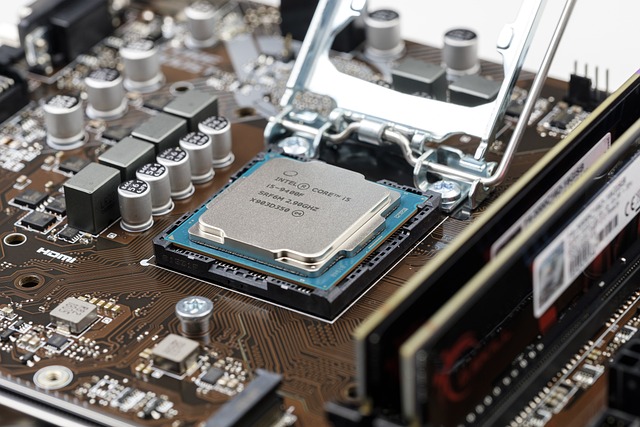

🕹Is Semiconductor turnaround on the horizon?🍄

As we spoke about Uncle Warren’s significant investment into TSMC, stock prices of many semiconductors rose sharply. Related counters such as AMD, QCOM and NVDA also increased with the optimism for the sector.

The rosy outlook is also supported by Infineon, which has revised its long-term targets upward as semiconductors demand rose and its fourth-quarter earnings beat expectations. This fuels the rally as investors buy back laggards in the upward swing cycle.

🎢Can the market continue?💎

With the sharp recovery of the indexes, say for the S&P 500, which had recovered by around 12% from its low of 3577 in early October, investors are getting ahead of the Fed in the pivot narrative, supported by recent data implying softening inflation.

For traders, the S&P 500 is at a resistance level near the 4200 and 4300 levels, where we had sold massive sellers roaming in during the early part of the year. With rising risk-on sentiments, there are high odds that the rally could continue, but sellers could return.

Pika World remains cautious in the near term. On valuation ground, if S&P 500 is to rise to the expected 4200 to 4300 level, it hints at the S&P 500 reaching around 18.5 times the total per shares earnings, which the companies are expected to roll in for next year. During this year, the low we hit was around 15 times.

The companies’ profits will reach about 5.4% of the total price at this multiple. This is just barely 1.6% higher than the 10-year Treasury yield. The additional equity risk premium, around 4% in the past, makes that valuation less appealing.

As such, while we are confident of the long-term upward trajectory of the equity market in the face of better inflation reading, Pika World is mindful of the fundamentals and may switch to a tactically conservative stance.

📮What’s on the menu today?📖

At 9.30 pm, we will send the Retail Sales data for MoM, which we expect to hit around 1% growth from just a natural 0% in the prior period.

At 10.15 pm, we will also have the Industrial production data, which is expected to rise by a smaller 0.2% compared to 0.4% earlier.

FOMC member Williams is also expected to speak at 10.50 pm, which will be critical. After all, the Fed has been trying to talk down on the market to sustain the decline in asset prices, hoping to impact consumption ability.

More Stories

💰Rejoice with Uncle Powell: Risk-on sentiment🥃

🎢Markets to the moon🗽

🍏A green apple a day keeps the bear away💰